Why Correct Classification Matters for Staffing Firms

Correct worker classification isn’t just a tax formality — it’s a cornerstone of compliance in the staffing industry. The IRS and Department of Labor are paying close attention, and a simple mistake can have costly consequences.

- Prevents costly IRS audits, fines, and back taxes: Misclassifying workers can trigger both federal and state investigations, leading to severe financial repercussions.

- Maintains compliance with both federal and state labor laws: Each state may have different standards, and staying compliant ensures your staffing firm operates legally across all jurisdictions.

Protects client relationships and your firm’s reputation: No client wants to be dragged into a misclassification issue. Accurate classification builds trust and reinforces your professionalism.

Do Staffing Agencies Receive 1099s?

The Internal Revenue Service (IRS) employment laws require every staffing agency to issue Form 1099-MISC when payments made in a given tax year meet or exceed $600.

Depending on the services performed or offered, staffing and recruitment agencies can provide temporary, contract, temp-to-hire, contract-to-hire, or direct employment. Temporary, contractor, temp-to-hire, and contract-to-hire are all services that fall under a 1099 tax classification. The only caveat is if your recruitment agency meets the corporation exemption.

- 1099 Deadlines: You must send 1099 forms to contractors by January 31 and file with the IRS by February 28 (paper) or March 31 (electronic).

- Late Filing Penalties: Fines range from $50 to $580 per form, depending on how late you are.

- Corporation Exemption: If the contractor is an incorporated business (such as an S-Corp or C-Corp), you typically do not need to issue a 1099.

Employees vs. independent contractors

When you are classifying a worker, you can either categorize them as a W-2 (employee) or 1099 (independent contractor). This distinction is important because you are required to pay payroll taxes on wages paid to employees, while payroll taxes, withholdings and workers’ workers’ compensation are generally not required for independent contractors. The problem is that, when it comes to determining who qualifies for a 1099 classification, the IRS has general guidelines which can be a bit unclear. It’s important that employees actually qualify for that classification because consequences for filing incorrectly are severe.

IRS Guidelines for Determining Worker Status

Understanding the IRS’s three-pronged test is critical for staffing agencies:

- Behavioral Control: Does your agency or client dictate when, where, or how the worker performs the job?

- Financial Control: Who pays for tools and supplies? Who bears the risk of profit or loss?

- Relationship Type: Is the engagement ongoing, or project-based? Are benefits or insurance offered?

If the answers point toward control and permanence, the worker likely qualifies as a W-2 employee.

The risks of misclassification

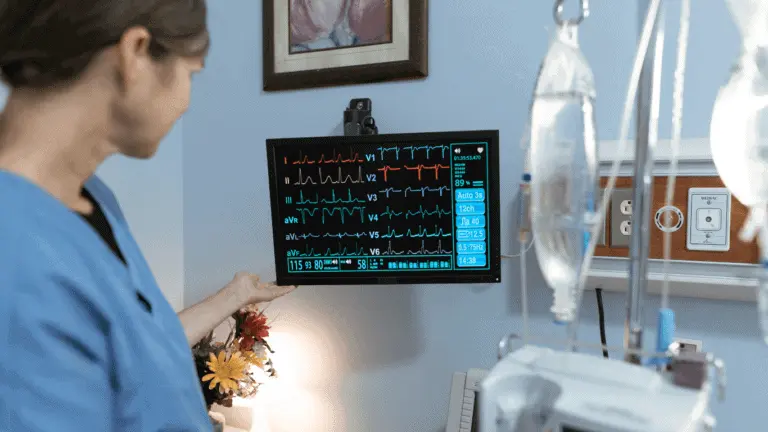

If a worker is classified as a 1099, there can be issues if they are let go and file for unemployment. You could be opened up to paying back taxes if you didn’t properly classify your employees the first time, and the IRS is really cracking down. In reality, most temporary workers should be classified as W-2s because they are not skilled workers who could use a 1099 like nurses or other professionals, and it’s best to err on the side of caution.

Common Misclassification Mistakes Staffing Firms Make

Many staffing firms inadvertently misclassify workers by:

- Assuming short-term workers qualify as contractors: Duration doesn’t determine classification — control and relationship type do.

- Using 1099s to avoid payroll taxes: This might seem cost-effective short-term, but can backfire dramatically under audit.

Ignoring state-specific rules: Some states use stricter tests than the IRS, such as the ABC test in California.

Best Practices for Avoiding Misclassification Issues

To protect your firm and clients, follow these best practices:

- Keep documentation: Always have written explanations for why a worker is classified as W-2 or 1099.

- Review classifications annually: Circumstances change — make sure your documentation reflects the current situation.

Educate your team

Train managers and sales teams on classification rules to avoid unintentional errors.

The takeaway

As a staffing firm, you need to do your due diligence to make sure your workers are truly qualified professionals if you are classifying them as independent contractors. Otherwise, you will likely be forced to pay steep penalties from the IRS, and could even face criminal punishments.

If you need help determining your income tax classifications, contact a member of our Back Office Operations team. We have an in-house tax department that is fully equipped to handle the burden of payroll tax support solutions, services, and administration, so you can focus on growing your staffing firm.

FAQs: 1099s and Worker Misclassification for Staffing Firms

Can a temporary worker ever be a 1099 contractor?

Yes, but only if they meet IRS guidelines for independent contractors. Most temp placements should be W-2.

What’s the penalty for misclassifying a worker?

Penalties can include back taxes, interest, fines up to $1,000 per worker, and potential criminal charges.

Do staffing firms always have to send 1099s?

Not always. If the vendor is incorporated, a 1099 may not be required. Check for the corporation exemption.

How can I verify correct classification?

Use the IRS’s three-pronged test (behavioral, financial, relationship) and consult legal or tax professionals.

What’s the difference between a W-2 and a 1099 in staffing?

W-2 employees are under company control with payroll tax obligations; 1099s operate independently with no employer withholdings.