What a Possible Recession Means for Your Staffing Firm

Last time updated: August 28, 2025

Recruiting & Hiring During a Recession

In light of the long-term global health crisis of COVID-19 and the accompanying economic uncertainty, many economists and analysts predicted a recession could be imminent. The continuing cycles of new COVID variants make the future unpredictable and wreak havoc on the US economy.

After a long period of recovery and job growth since the Great Recession of 2008, the tide may be turning. We currently live in uncertainty and are experiencing troubling economic factors: a global pandemic, Federal Reserve interest rates at zero, an oil price war, and turmoil over the U.S. presidential election. With recession fears looming, what goes up must eventually come down.

A recession is bound to happen at some point because that is the nature of business cycles. It is worth it for staffing agency owners to consider what a possible recession means for staffing, how to weather the storm, and what can be done to prepare.

What Causes a Recession?

Recessions are part of the natural business cycle, which includes periods of growth (expansion), peak activity, decline (contraction), and recovery. A recession occurs when the economy contracts for an extended period, often marked by declines in GDP, employment, and spending.

Several factors can push an economy into recession:

- Inflation and interest rate hikes: To combat rising inflation, central banks raise interest rates, which slows borrowing and spending.

- Falling demand: Consumer or business cutbacks in spending can trigger widespread slowdown.

- Tight credit: When access to loans dries up, business investment and hiring often stall.

- Global events: Geopolitical conflicts, pandemics, or supply chain disruptions can cause economic ripple effects.

Staffing is often among the first industries impacted during a downturn. Employers typically scale back temporary and contract workers before reducing full-time staff. Because staffing is flexible, it’s also one of the first to rebound when recovery begins, as companies test the waters with contingent labor before committing to permanent hires.

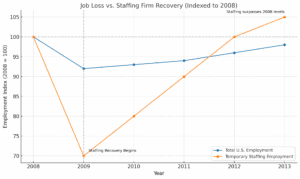

How the last recession affected the job market

The Great Recession of 2008 is still fresh in the minds of many business owners. We survived a cumulative decline of 5.1% in GDP as a country, saw 8.7 million jobs disappear, hiring freezes, and discouraged job seekers. It took almost five years to recover the jobs lost during the 18 months of the Great Recession.

One key trend from that period: the staffing industry was among the first to feel the downturn—and among the first to bounce back. When uncertainty rises, businesses typically scale back flexible labor first. But as recovery begins, they often rehire contract workers before committing to full-time roles, making staffing a leading indicator of economic rebound.

Job Loss vs. Staffing Recovery Timeline

- 2008–2009: U.S. loses 8.7 million jobs

- Q4 2008: Temporary staffing employment drops by 30%

- Mid-2009: Staffing begins recovering—months ahead of full-time job growth

- By 2013: Temporary staffing surpasses pre-recession levels, while total U.S. employment still lagged

This “early out, early back” trend highlights both the vulnerability and resilience of staffing firms during economic swings—and why it’s critical to have flexible financing and operational agility when cycles shift.

How the last recession affected the recruitment industry

In terms of the staffing industry, US staffing revenue declined 28% in 2009, and more than a third of staffing employees lost their jobs. The industry bounced back relatively quickly compared to other ones, reaching pre-recession highs in 2011 and 2012. The rest of the economy did not recover fully until 2014. Staffing revenue has grown ever since as a tightening labor market, and skills gaps made such services even more in demand, and as of recently, we have nearly doubled revenue since the dip in 2009.

Is a new recession coming soon?

Despite all of our data and knowledge, recessions are still tough to predict. Since World War II, there have been 11 recessions. The latest economic expansion we are in began in mid-2009, making it the third-longest growth in history. Unfortunately, good times cannot last forever, and several indicators suggest the economy may be slowing.

Key Indicators

- GDP growth slowed to 1.2% in early 2025, down from 2.8% in 2024.

- Job gains have cooled significantly—only 35,000 jobs added in July, with downward revisions to previous months.

- Unemployment ticked up to 4.2%, the highest in nearly two years.

- Consumer spending is weakening, especially among middle-income households.

- Tariffs and trade tensions have dampened business investment and market confidence.

What Economists Are Saying

Economists estimate a 33% to 60% chance of recession, citing soft hiring, high interest rates, and global uncertainty. While a downturn isn’t guaranteed, the overall outlook suggests that staffing firms should prepare for potential volatility in the months ahead.

Could We Experience A Double Dip Recession?

A double-dip recession is an economic downturn where a small recession is followed by a short recovery period, then quickly another recession, usually worse than the first. This can also be called a W-shaped recovery. Double-dip recessions are often caused by repeating crises, or by government policies that deliberately or inadvertently slow economic growth.

How Does A Double Dip Recession Affect Staffing Firms?

The staffing industry is often the first to feel the effects of a recession, and the first to recover as hiring increases. A double dip recession is likely to cause a “false spring” for staffing where contingent workers return to work, followed shortly by more job cuts and losses.

Why “False Springs” Are Tricky for Staffing Firms

These short recoveries can strain cash flow. Staffing firms ramp up payroll and onboarding costs in response to client demand, but if clients pull back suddenly, agencies are left with unpaid invoices and ongoing expenses. This mismatch in timing can create liquidity pressure right when stability seems to be returning.

For example, In mid-2020, many firms rehired contingent workers as lockdowns lifted and demand rebounded. But with the rise of new COVID-19 variants and renewed restrictions later that year, job orders were again slashed. Especially in hospitality, manufacturing, and events. For staffing firms, this led to whiplash in revenue, operational strain, and the need to scale down a second time.

How Can Staffing Firms Prepare for A Double Dip Recession?

Preparing for a double dip recession involves the same principles as preparing for a regular recession: Focus on your strengths, make sure your customer mix is diverse, and have a strong internal team. Most importantly, build financial flexibility—through access to working capital, funding partners, or payroll financing—to weather demand swings without jeopardizing operations.

The conditions of a recession

Recessions don’t happen all at once—they’re usually preceded by several warning signs:

Fed Rate Hikes

To fight inflation, the Federal Reserve often raises interest rates. Higher rates increase borrowing costs, slow business investment, and can push the economy toward recession if maintained too long.

Falling Consumer Confidence

When people feel uncertain about the economy, they spend less. A drop in consumer confidence often leads to reduced demand—impacting revenue and triggering cutbacks.

Hiring Freezes

Before layoffs, many companies freeze hiring. A rise in freezes across industries is one of the earliest signals of a slowdown—especially relevant for staffing firms watching demand trends.

Why the next recession could be worse

Historically, the longer that goes between recessions, the worse it is for the American public. As previously stated, we are in the midst of the third-longest economic expansion in recent history. A few factors make the next recession a cause for concern, beyond just the regular concerns of job security and financial stability.

One factor that could contribute to a worse recession is that unemployment insurance is harder to get than ever before. During the massive layoffs of the Great Recession, Congress increased the duration of unemployment benefits beyond 26 weeks that states provide. Since then, Congress has allowed those benefits to expire and many states have cut their unemployment programs or made it harder to get or keep them with additional requirements and scrutiny.

Another unique aspect of the next recession will be the prevalence of alternative work – aka temporary jobs with no benefits, such as driving for Lyft or Uber, or even social media influencing.. 16% of the workforce currently takes part in alternative work, or gigs, and in a recession that is likely to grow. The people working such jobs may also be ineligible for unemployment since if they’re not actual employees of the firm they work for their state won’t have W2 forms on file reflecting their earnings.

As gig work and non-traditional labor models grow, staffing firms may need to adjust their strategies—expanding services to accommodate independent contractors while educating clients on the risks and benefits of using 1099 labor.

This also brings heightened compliance risk. In a recession, audits and worker classification challenges tend to increase. Firms heavily reliant on 1099 workers must ensure proper documentation and clear worker classifications to avoid penalties, fines, or legal issues.

Top Ways You Can Prepare Your Recruitment Agency for a Recession

- Diversify your client roster – Make sure the companies and industries you serve are diverse. If you are only staffing one sector, you could take a larger hit.

- Work with reliable companies – small clients can be more fragile during an economic downturn.

- Know what resources are available to you – Open lines of credit, grant resources, PPP loans, and more. All these allow you to retain employees and make your agency recession-proof.

- Refine your hiring process – Improve job postings, choose qualified candidates with experience and employees with a wealth of knowledge. Hiring top talent and quality candidates with vast experience will ensure you can cover multiple skillsets during hard times.

- Use Predictive Cash Flow Forecasting – Understanding your future cash needs is critical. Regularly run cash flow models under different economic scenarios so you can make proactive decisions, not reactive ones.

- Leverage Funding to Stay Resilient or Scale – Many staffing firms stayed afloat, or even grew, during the last recession by using funding to meet payroll, seize new client opportunities, or acquire struggling competitors.

- Use the Right Partners – Advance Partners provides flexible payroll funding and back-office support built specifically for staffing firms. Learn more about our staffing firm services here.

What happens to the staffing industry in a recession?

So what is a recession’s impact on staffing? The main reason that companies use staffing firms is flexibility. So in a recession, often the first costs to go are contingent workers. It is less of a blow to morale, and there are no severance or separation packages to deal with. On the flip side, staffing firms are also relied on for affordable labor when looking to cut back on benefit payments.

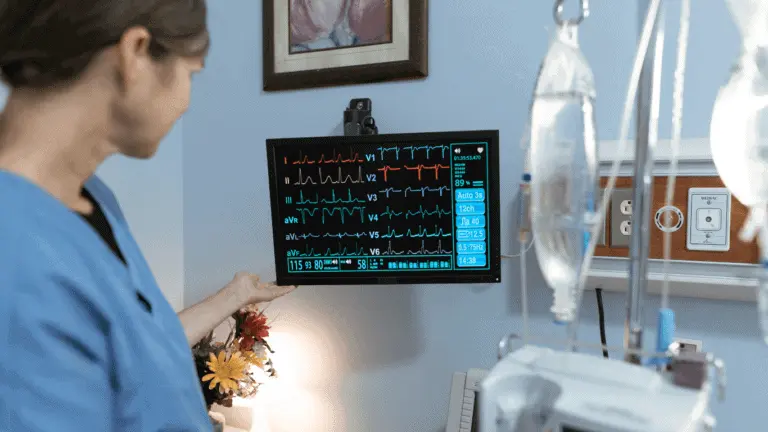

Does Hiring Always Decrease In A Recession?

The short answer is, it depends on the industry. Is recruiting recession proof as a whole? Not necessarily, but some companies are hiring during a recession. For instance, healthcare companies, government, IT/Technology, and education are a few industries that might be considered “recession proof.” For staffing firms, these sectors offer strategic opportunities to shift focus and fill ongoing labor needs.

Additionally, staffing metrics—such as new job orders, temp hours worked, and fill rates—are often viewed as economic leading indicators, meaning they can reflect changes in business confidence and hiring intent before broader economic data does.

Temporary Labor In A Recession

Temporary labor in a recession can be described as FIFO: first in, first out. Contingent workers are often the first to be let go when a downturn hits and the first to be brought back as the economy recovers.

Staffing trends serve as a leading indicator of broader employment shifts. When temporary job placements decline, it’s often a sign that full-time layoffs may follow.

The main reason companies use staffing firms is flexibility. In a recession, cutting contingent labor allows businesses to lower costs without triggering severance packages or hurting morale. On the flip side, during recovery, firms often prefer short-term contracts before committing to full-time hires—providing new opportunity for staffing companies.

To anticipate a rebound, staffing firms can track:

- Increases in temp-to-hire conversions

- New job order volume

- Client requests for short-term or project-based roles

These are often signs that employers are cautiously re-entering the hiring market.

What is The Key to Surviving a Recession as a Staffing Firm?

- Find Other Ways to Help – If no one is hiring, what core competencies can your staffing business offer? Can you help with resumes and outplacement? Can you offer your clients advice on staffing or recruiting? Don’t be afraid to shift gears or think outside the box to keep your business going.

- Manage Your Roster Wisely – Your staff is the most important asset your business has. Unfortunately, it is also your highest cost. Be honest and be transparent, but sometimes layoffs are the only way to survive. The best thing you can do is be strategic about who stays and who goes, thinking forward to who can help you when the economy turns around. And if you received a Paycheck Protection Program loan to prevent layoffs, be sure to understand the forgiveness rules. It is probably wise to seek legal or accounting help or both.

- Practice What You Preach – Many staffing firms equip themselves for economic volatility by using flexible labor themselves. If a certain number of your recruiters are contingent workers, you can more easily scale down and back up to adjust to swings in demand, just as your clients can.

- Watch the “Danger Zone” – Despite what you might think, the most challenging period for staffing firms is not the beginning or the middle of a recession; it’s the end. As business gradually improves, growing your headcount will suck cash out of your business precisely when you are likely to be in your weakest position to fund growth. Having enough working capital available during growth periods is extremely important.

- Update Your Business Plan and Budget – The staffing industry is changing fast. Some of you have orders to fill because specific industries are booming, other of you have candidates and no demand. Regularly update your business plan to reflect current demand. Cut non-essential expenses like travel and low-ROI marketing, but protect core operations like payroll, recruiting tools, and revenue-generating tech. Focus spending where it supports client retention and growth.

- Request Better Terms – In a recession, cash is king. Talk to your current clients regarding payment terms because better collection equals more cash on hand to cover emergencies and keep the doors open.

- Diversify your verticals – If you are currently struggling during this downturn, consider what verticals are not. It might be worth it to expand your offerings to turn a bad situation into an opportunity.

- Make QBRs (Quarterly Business Reviews) a priority – QBRs aren’t just corporate formalities, they’re strategic tools, especially in volatile times. Use them to assess financial health, client satisfaction, and internal performance. Reviewing what’s working (and what isn’t) on a quarterly basis allows you to make proactive decisions before small issues become big problems. QBRs also keep your leadership team aligned and focused on short-term execution and long-term goals.

- Set staggered growth goals and adopt a slow hiring ramp-up – Instead of aiming for rapid expansion, break your goals into smaller, phased milestones. This allows your firm to stay flexible and responsive to market conditions. When it comes to hiring, don’t rush. Ramp up slowly and intentionally, focusing on key roles that contribute directly to business development, client service, or operational efficiency.

What to do about it now?

The best thing to do in an environment where a recession seems imminent is to keep tunnel vision on your business. Rather than trying to time the market, focus on what you do best: helping place talent in companies that need it. While there is not a lot you can do to plan for a recession, it might be prudent to consider how your business would approach various revenue scenarios, such as a 20-30 percent downturn if a recession were to hit.

You also have to consider whether your staffing firm has enough liquidity on hand to weather a crisis. A line of credit with a bank is one option. It is worth looking into specialty funding like invoice factoring to improve your cash flow. Payroll funding companies are not subject to the same government oversight as banks and do not require as much scrutiny. For some staffing firms, specialty financing might be the better way to go.

What Matters Most In A Recession

Mindset matters: Proactive > Reactive

In times of economic uncertainty, the firms that prepare in advance have a better chance of thriving. Don’t wait until your business is impacted—take action now. Model different revenue scenarios, evaluate expenses, and secure funding ahead of time. A proactive approach protects your firm and gives you more options when the market shifts.

Think beyond emergency funding: Advance as your long-term growth partner

Advance Partners isn’t just here for emergencies—we’re built for the long haul. Our funding, back-office support, and industry expertise are designed to help staffing firms grow sustainably, even during downturns. Whether you’re scaling, stabilizing, or navigating tough times, we’re with you every step of the way.

For a more in-depth look at staffing firms and recessions, download the free whitepaper The Staffing Firm Guide to Navigating a Recession. For more information on payroll funding, request a free funding consultation today.

For a more in-depth look at staffing firms and recessions, download the free whitepaper The Staffing Firm Guide to Navigating a Recession. For more information on payroll funding, request a free funding consultation today.

Up Next