7 Items to Check Off Your ‘To Do’ List by Year-End

Last time updated: December 16, 2024

As the last quarter draws to a close and staffing firms all over the country start looking ahead, it’s time to start thinking about ways to end your year strong and be positioned for strength for the next. Plus, there still might be time to make some decisions that could affect your taxes.

We have put together a brief list of checklist items to consider as you close out the year. For the full detailed list, download the Year-End Checklist for Your Staffing Firm whitepaper.

1. GET YOUR FINANCES IN ORDER

The first step to closing out the year is getting your books in order. If you have a bookkeeper or an accountant, that helps tremendously. For some smaller firms though, it is all on you and could be where you will spend the bulk of your time at year-end.

2. DECIDE ON YEAR-END TAX STRATEGIES

It is likely not too late to evaluate your tax strategies and make any necessary adjustments. Take advantage of tax credits, and don’t spend money that you wouldn’t ordinarily spend just to reduce your tax bill. In other words, $1 will not equal $1 of tax saved in deduction, so you still only want to spend on goods or services that your business truly needs.

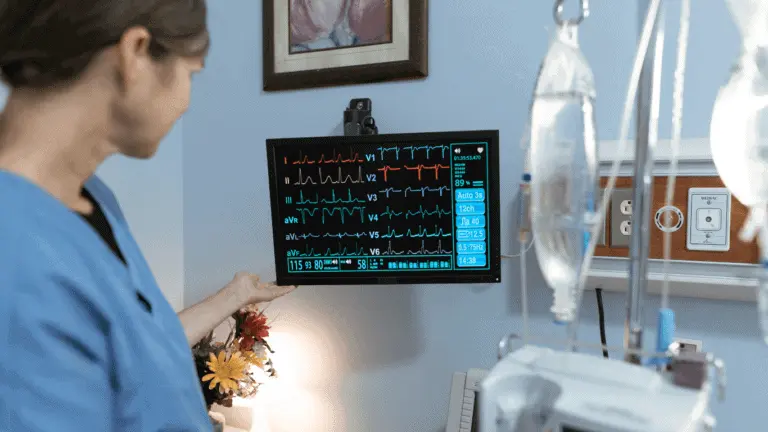

3. MAKE SURE YOU ARE COMPLIANT

While the future of the Affordable Care Act is uncertain in the current political climate, the IRS has given indications that you must still adhere to ACA health coverage requirements for the foreseeable tax filing season. For instance, the IRS issued penalty notices this year for ACA noncompliance under IRC Section 4980H for the 2017 tax year, indicating that they are intensifying enforcement efforts. If you’re unsure of your obligations, don’t hesitate to reach out to Advance Partners or other industry experts.

4. REVIEW YOUR STAFF COMPENSATION AND BENEFITS

Year end is a good time to review benefits and compensation for the next year, as well as stay on top of any issues or corrections that need made by the end of the year. Will you give your employee’s year-end bonuses? Will you provide raises? Are your taxable fringe benefits accounted for? These are all things to consider as you budget and plan for the new year.

5. AUDIT YOUR OFFICE

Take stock of your equipment needs for your staffing office. Does your staffing firm need new computers or furniture? If so, there are several ways to write-off the cost of purchases, as long as you place the items are ready for use in your business by the end of the year.

6. BE PREPARED FOR A WORKER’S COMP AUDIT

You may be about to undergo a workers’ compensation audit before or after year end. If your workers compensation policy is expiring before the end of the year, your insurer will likely initiate the audit process soon after. Preparing for an audit can seem daunting, but there are steps you can take to make the process run smoothly.

7. DETERMINE GOALS FOR NEXT YEAR

Finally, it’s time to plan out your road map for next year. Using your financial statements, customer feedback and input from your team, assess your goals for the previous year and determine how well you did. Did you achieve what you set out to do? Or did you find yourself taking an unexpected path to a different kind of success? What are the keys to success for next year?

These are just a few things to keep in mind as you close the year out. If you’re interested in more detailed information on these points, download the free whitepaper on the same subject. If you have any questions or want more information about payroll tax services and solutions or how payroll financing can help your staffing firm grow faster, please contact us today.

Up Next